The Of Estate Planning Attorney

The Of Estate Planning Attorney

Blog Article

Estate Planning Attorney - Questions

Table of Contents7 Easy Facts About Estate Planning Attorney ShownWhat Does Estate Planning Attorney Do?3 Easy Facts About Estate Planning Attorney DescribedTop Guidelines Of Estate Planning AttorneyThe 6-Second Trick For Estate Planning Attorney

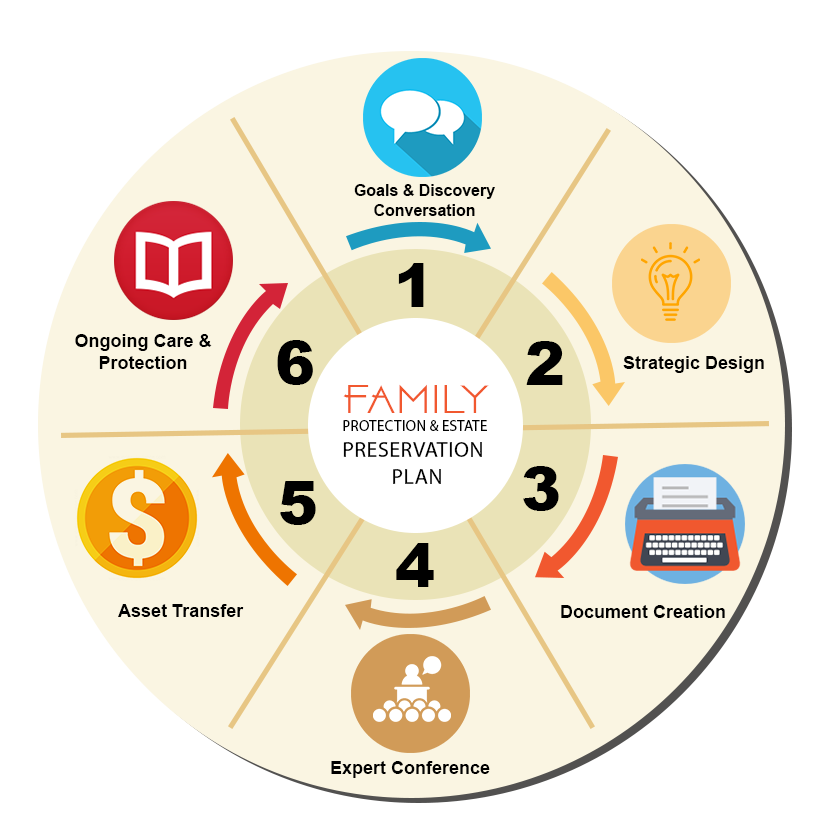

Dealing with end-of-life decisions and protecting family members riches is a difficult experience for all. In these tough times, estate preparation attorneys aid people prepare for the distribution of their estate and establish a will, trust, and power of lawyer. Estate Planning Attorney. These lawyers, likewise referred to as estate law attorneys or probate attorneys are licensed, seasoned specialists with a thorough understanding of the federal and state laws that put on exactly how estates are inventoried, valued, spread, and tired after fatality

The intent of estate planning is to appropriately prepare for the future while you're audio and qualified. An effectively ready estate plan sets out your last wishes exactly as you want them, in one of the most tax-advantageous way, to avoid any concerns, false impressions, misconceptions, or disputes after fatality. Estate preparation is an expertise in the legal occupation.

The 15-Second Trick For Estate Planning Attorney

These attorneys have an extensive understanding of the state and federal legislations associated to wills and trusts and the probate procedure. The responsibilities and duties of the estate attorney may include therapy customers and preparing legal files for living wills, living counts on, estate plans, and estate taxes. If needed, an estate planning lawyer may take part in litigation in court of probate in behalf of their customers.

According to the Bureau of Labor Statistics, the work of lawyers is expected to grow 9% in between 2020 and 2030. Regarding 46,000 openings for lawyers are forecasted each year, typically, over the decade. The course to ending up being an estate preparation attorney is similar to other method locations. To enter into law college, you need to have an undergraduate degree and a high grade point average.

Ideally, consider opportunities to gain real-world job experience with mentorships or internships associated with estate planning. Doing so will certainly provide you the abilities and experience to gain admittance right into law institution and network with others. The Regulation School Admissions Test, or LSAT, is a vital element of applying to regulation institution.

Usually, the LSAT is available 4 times annually. It is necessary to plan for the LSAT. Most possible trainees start researching for the LSAT a year beforehand, typically with a study hall or tutor. Most regulation pupils look for legislation school during the loss semester of the last year of their undergraduate researches.

Getting My Estate Planning Attorney To Work

On average, the annual wage for an estate attorney in the U.S. is $97,498. Estate preparing lawyers can function at big or mid-sized legislation firms or branch out on their own with a solo technique.

This code relates to the limits and policies enforced on wills, counts on, and other legal papers pertinent to estate preparation. The Uniform Probate Code can vary by state, however these laws regulate various aspects of estate planning and probates, such as the production of the trust or the legal credibility of wills.

Are you unsure about what occupation to seek? It is a difficult question, and there is no easy response. You can make some factors to consider to help make the decision simpler. Sit down and detail the points you are excellent at. What are your toughness? What do you appreciate doing? When you have a checklist, you can tighten down your alternatives.

It involves deciding just how your possessions will certainly be dispersed and who will manage your experiences if you can no more do so yourself. Estate preparation is an essential component of monetary planning and anonymous should be finished with the help of a certified expert. There are numerous variables to take into consideration when estate check out here preparation, including your age, wellness, monetary situation, and family situation.

Estate Planning Attorney Fundamentals Explained

If you are young and have few possessions, you might not need to do much estate preparation. However, if you are older and have a lot more belongings, you must take into consideration distributing your properties among your successors. Wellness: It is a necessary element to take into consideration when estate planning. If you are in excellent health, you may not require to do much estate preparation.

If you are wed, you must think about exactly how your properties will be dispersed in between your partner and your heirs. It aims to make sure that your possessions are distributed the means you want them to be after you pass away. It includes thinking about any kind of taxes that might need to be paid on your estate.

The 9-Minute Rule for Estate Planning Attorney

The attorney also assists the people and family members develop a will. A will certainly is a legal paper stating exactly how individuals and households his comment is here want their properties to be dispersed after fatality. The attorney additionally helps the individuals and families with their trusts. A trust is a lawful paper enabling people and households to transfer their assets to their recipients without probate.

Report this page